Back to Blog

Published on July 9, 2025

why Cloud now: bankstream

overview of darwin.Cloud's bankstream feature for real-time bank account and credit card data streaming with automated financial integration.

key takeaways

- bankstream automates expense entry by pulling transactions directly from bank/credit card accounts

- classification rules can be set up to auto-categorize recurring expenses

- proper supplier entry enables better reporting and potential 1099 tracking

- two-step approval process available: classify → approve → post to bank reconciliation

- bank reconciliation process is streamlined with auto-reconcile feature when using bankstream

topics

bankstream overview

- connects darwin to bank accounts and credit cards

- pulls in expenses directly, reducing manual entry

- allows classification of single items, multi-line expenses, and by billing groups

- enables setting up recurring rules for auto-deletion (e.g., checks, forte batches)

- significantly reduces manual bill entry once rules are established

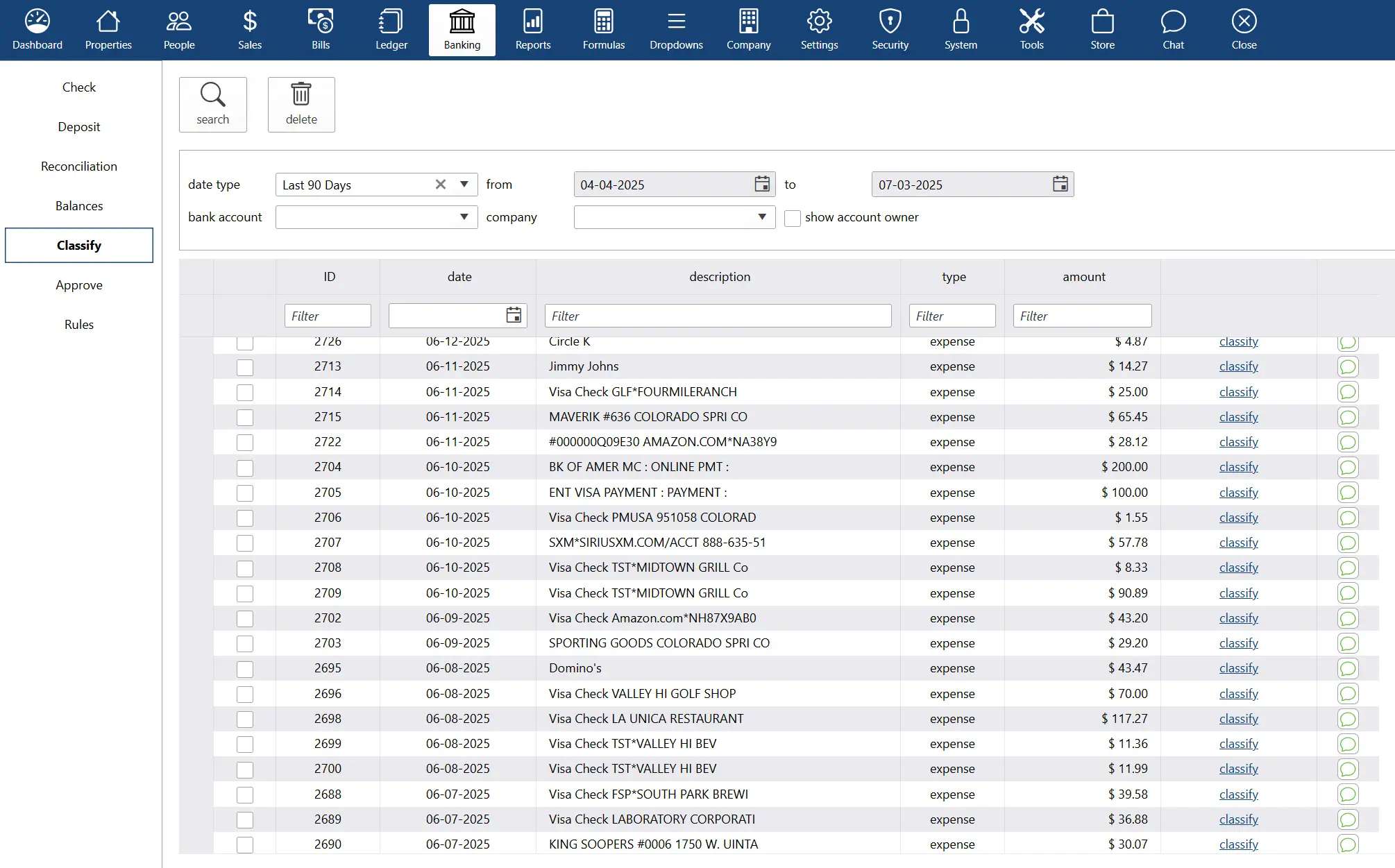

classification process

- access via banking menu → classify

- select date range and bank account

- click 'search' to populate transactions

- choose classification type: single line, multi-line, or billing group

- enter gl account, office, and supplier for each transaction

- option to create recurring rules for future auto-classification

approval and posting

- access via banking menu → approve

- review classified items, focusing on 'not approved' status

- option to reclassify if needed

- check items to approve, then click 'approve and post'

- posting is crucial to move items to bank reconciliation

communication feature

- chat icon allows sending messages about specific transactions

- useful for querying unusual expenses or getting clarification

- responses are saved in darwin for audit trail

bank reconciliation integration

- bankstream provides comprehensive transaction data, including checks and deposits

- auto-reconcile feature can handle 80-90% of reconciliation process

- streamlines reconciliation by having all data readily available

vendor tracking for credit card expenses

- challenge: credit card charges don't appear under vendor records like checks do

- current workaround: use 'approve' screen in bankstream, filter by year and credit card, then search for vendor name

- potential feature request: add vendor filter in inquiry screen for easier tracking across gl accounts

next steps

- attend tomorrow's q&a session for step-by-step guidance on bankstream setup and classification rules

- consider feature request for vendor filtering in inquiry screen to improve expense tracking by vendor

- schedule one-on-one session for lyndsey to address budget setup and overall darwin accounting implementation

- explore potential enhancement to add vendor filtering in inquiry screen without gl account restriction

watch this short video to learn more:

ready to evolve?

request a demo or learn more about the power of darwin.Cloud