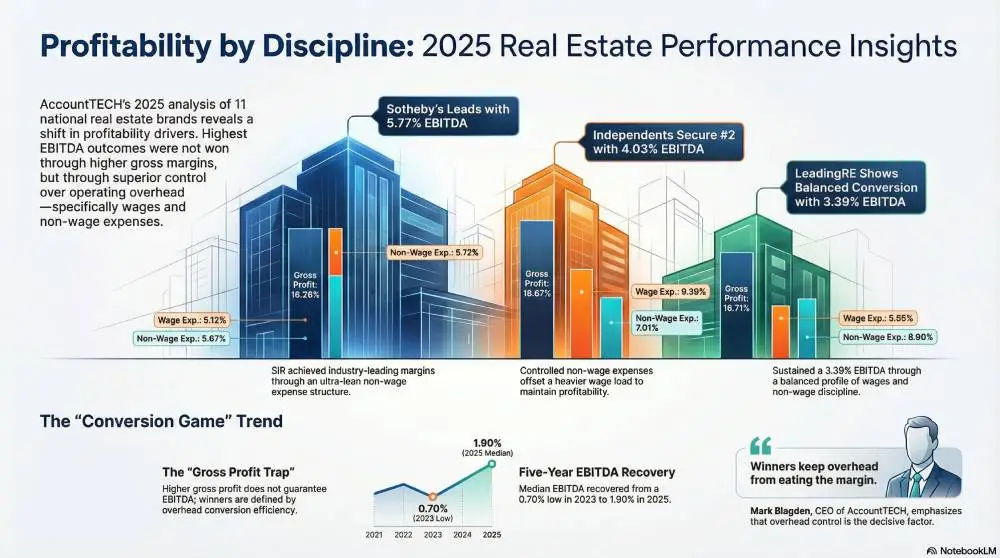

sotheby’s international realty leads the way in profitability for 2025

study finds leadership is won in overhead discipline—not gross margins; independent brokerages and leadingre round out the top three.

today accounttech released its 2025 median performance findings across 11 national real estate brokerage brands, based on brand-level median financial results. the analysis shows a clear theme in 2025: the highest EBITDA outcomes were driven primarily by tighter operating overhead (wages + non-wage expenses), not meaningfully higher gross profit.

2025: highest performing brand and top 3 EBITDA leaders:

accounttech’s 2025 median EBITDA margin leaders were:

- sotheby's international realty (sir) — 5.77% median EBITDA margin (highest)

- independents — 4.03% median EBITDA margin

- leading real estate companies of the world (leadingre) — 3.39% median EBITDA margin

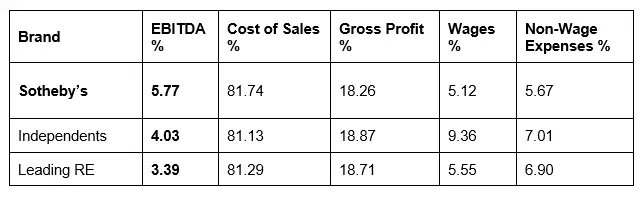

2025 operating profile (medians as % of income)

how the top 3 brands earned the highest EBITDA in 2025

accounttech’s review of the core operating levers—cost of sales, gross profit, wage expenses, and non-wage expenses—show a consistent EBITDA formula among the leaders:

1. sotheby's international realty: EBITDA leadership through ultra-lean overhead

sotheby's cost of sales and gross profit profile sit near the industry “center” in 2025, but the differentiator is operating overhead—particularly non-wage expenses at 5.67%, an unusually lean expense structure. with normal gross profit numbers, sotheby's discipline with low operating overhead has them converting it into EBITDA at the highest rate in the accounttech research.

2. independents: strong EBITDA despite higher wages—because non-wage expenses stay controlled

independents post slightly higher gross profit than sir/leadingre, but also carry materially higher wages (9.36%). the reason independents still land #2 is that non-wage expenses remain relatively contained (7.01%). independents’ 2025 EBITDA performance is the outcome of decent gross profit + disciplined non-wage overhead, even with heavier wage load.

3. leadingre: balanced model with disciplined overhead

leadingre’s cost of sales and gross profit are similar to the other leaders, but it sustains strong EBITDA through a balanced overhead profile: wages at 5.55% and non-wage expenses at 6.90%. the result is a steady conversion of gross profit into EBITDA without relying on exceptional gross margin.

key 2025 takeaway: among the top performers, gross profit differences were modest. EBITDA separation came from how tightly brands controlled wages and—especially—non-wage expenses.

five-year trend insights (2021–2025): what changed

looking across the past five years of brand medians, accounttech observed several notable patterns:

1. EBITDA compression in 2022–2023 was driven by overhead inflation

the median EBITDA (across brand medians) declined sharply after 2021 and remained compressed through 2023, before recovering in 2024–2025:

● 2021: 3.53%

● 2022: 0.81%

● 2023: 0.70%

● 2024: 1.68%

● 2025: 1.90%

during that period, gross profit remained comparatively stable through 2024 (~19.6–20.2%), while non-wage expenses stepped up materially (from 7.71% in 2021 to roughly 10–11% in 2022–2024). in short: overhead expanded faster than gross profit could support, compressing EBITDA.

2. 2025 shows margin pressure—but an operational “reset” on expenses

in 2025, the median cost of sales increased and median gross profit fell (median gp down to 18.26%), yet EBITDA improved modestly versus 2024. that combination points to a 2025 reality: brands protected EBITDA by tightening non-wage expenses (median non-wage expenses improved to 9.42% in 2025).

3. the “gross profit trap”: higher gross profit does not guarantee high EBITDA.

several brands posted higher gross profit than the leaders in certain years, yet did not translate that advantage into EBITDA due to heavier operating structures. the consistent lesson across the five-year view is that EBITDA is a conversion game: gross profit matters, but conversion efficiency (overhead control) decides who leads.

“brokerage leaders often focus on their commission economics as the primary profitability driver,” said mark blagden, founder & ceo of accounttech. “our 2025 medians show something more decisive: when gross profit is relatively close across brands, the winners are the operators who keep overhead from eating the margin—especially non-wage expenses.”

methodology (summary)

this analysis is based on a research of brand-level median performance metrics across 11 national real estate brokerage brands and years 2021–2025, including:

● cost of sales (% of income)

● gross profit (% of income)

● wage expenses (% of income)

● non-wage expenses (% of income)

● EBITDA (% of income)

brand entries include company counts per year; results are presented as medians at the brand-year level.

ready to evolve?

request a demo or learn more about the power of darwin.Cloud