darwin.Cloud Profit per Agent - it's more than just commission split

Profit per agent is just commission split ... it's what's left after expenses

Profit per Agent isn't their commission split

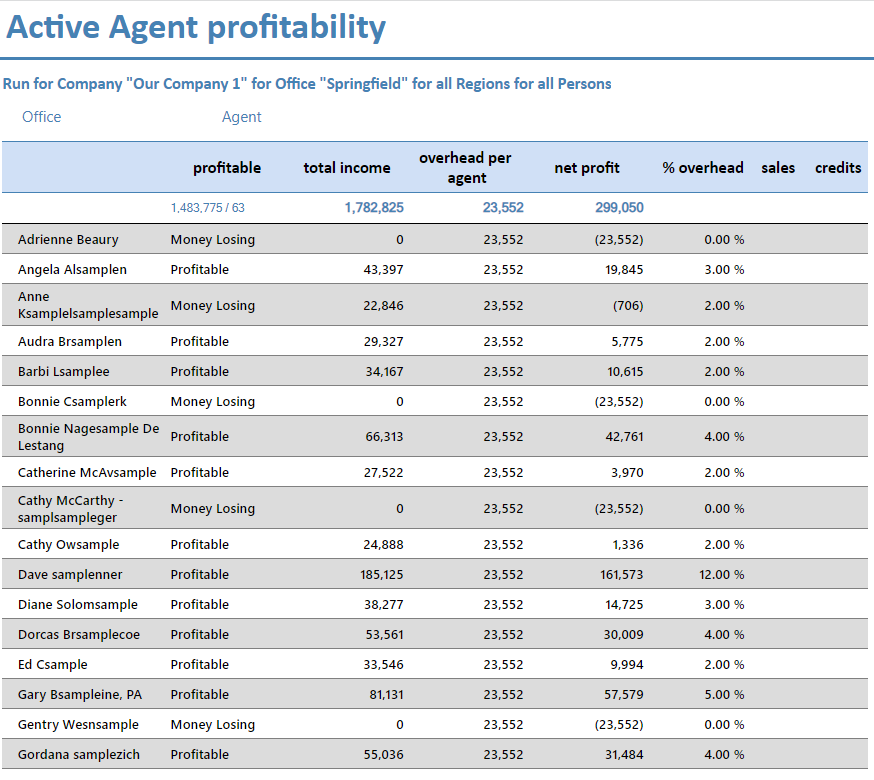

When we think about profit per agent, it is tempting to see how much the company has made from an agent’s closings or how much we have invoiced them for their private office. But that isn’t really Net Profit.

Your office has overhead - probably, alot of it. It isn’t enough to know how much money you are making from each agent. You also need to know how much it costs, PER AGENT, to have your office open. When you compare your overhead per agent to your income per agent, you get true insight into the financial value of each agent to the brokerage.

The other key insight from this type of analysis relates to commission splits. It is very common to have agents that are closing deals (maybe many deals) but still not earning enough for the office that they are even “covering” their fare share of the office overhead. This happens when an agent’s split is “too sweet”. The takeaway here is that for agents that are not profitable to the brokerage, it is not always necessary to terminate them. Sometimes, you can make an agent profitable to the brokerage by just adjusting their commission split.

Finally, when you look at overhead per agent - and you compare it to profit per agent, you might find there is a consistent disconnect. It could be that “how much” you are spending to keep the office open is not in-line with how much commission split agents are willing to pay to work for you. In this case, the solution for profitability might be to adjust your overhead down to a level that makes sense for how much agents are paying you.

To truly understand the net profit to the brokerage of each agent, follow this simple exercise:

Step 1: Add up your expenses

Total up ALL your expenses for the last 12 months. Include everything. Rent, Labor, Payroll taxes, Advertising …. everything.

Step 2: Divide by Agent count

When you have that number, divide it by the number of agents in your company. For example, if your total expenses in the last 12 months was $850,000 and you have 60 agents in the company. Then the overhead per agent will be $14,166.

Step 3: Calculate total income for each Agent

Now, calculate the income (after royalty fees, recruiting bonuses, etc) from each agent in the last 12 months. Be sure to include not just the company split from closings, but also any money you make from charging your agents rent or fees for working in the company.

Step 4: Do the Math

Compare the income to the costs for having the office open.

sample report view

see other reports that combine financials with agent production

Ready to evolve?

Request a demo or learn more about the power of darwin.